The Cerro Las Minitas project is located about 70 kilometres to the northeast of the city of Durango in Durango State, Mexico, and is accessed easily by road. The property comprises 25 concessions, totalling approximately 34,450 hectares, and lies within heart of the Faja de Plata (Belt of Silver) of north central Mexico. The belt is one of the most significant silver producing regions in the world, with current reserves/resources and historic production in excess of 3 billion ounces of silver.

Preliminary Economic Assessment Announced August 29th 2022

Preliminary Economic Assessment (‘PEA”) on the Cerro Las Minitas project provides a positive valuation with further upside potential.

PEA Highlights (all figures in $US unless otherwise noted):

Robust Project Economics - Base Case: after-tax NPV5% of $349M (C$450M) and IRR of 17.9% (using Ag- $21.95/oz, Cu – $3.78/lb, Pb – $0.94/lb and Zn - $1.33/lb);

Excellent Silver and Zinc Price Leverage - Base-case +15%: after-tax NPV5% of $561M (C$730M) and IRR of 24.4% (Ag- $25.24/oz, Cu – $4.35/lb, Pb – $1.08/lb and Zn - $1.53/lb);

Large-Scale Underground Mining Operation with a 15-year mine life with an annual average plant feed of 14.2 Mozs AgEq (inc. 5.8 Mozs Ag) at an AISC of $13.27/oz AgEq sold;

High-Revenue Project: Base Case gross revenues total US$3.7B with silver representing 42% of revenues, zinc representing 39% of revenues. The project has an Initial CapEx of $341M and an NPV-to-CapEx ratio of 1.0X;

Well Located Project in a mining friendly jurisdiction with excellent infrastructure in southeast Durango state, Mexico; and

Further Exploration Upside: Drilling through to August 2022 has confirmed mineralized extensions to the Mina La Bocona and Skarn Front deposits that have not been incorporated into the current Resource Model. Other deposits remain open laterally and to depth and remain to be explored.

For additional information on the preliminary economic analysis, click here.

Geology and Mineralization

To date, Southern Silver has identified six high-grade silver-polymetallic deposits, the Blind zone, El Sol zone, Las Victorias Zone, Skarn Front Zone, South Skarn Zone and the Bocona Zone, whichhave been partially delineated, as well as several other high priority targets throughout the property. For a list of select intercepts from all the drilling to date, click here.

The Blind, El Sol and Las Victorias zones are a series of near-surface silver-polymetalic “dyke-replacement style” deposits that occur in the immediate vicinity of an aplite-monzonite dyke swarm with a NE-SW orientation that occur to the west of the central monzonite intrusion. The Skarn Front Zone, South Skarn Zone and Bocona Zone are zones of silver-polymetallic mineralization that are found at or near the boundary between the skarn and marble alteration facies in the halo of the central monzonite intrusion. This mineralization has been delineated up to depths of greater than 1km and is open along strike and to depth.

In 2017, an extensive regional sampling program on the newly staked CLM West claims identified a large, 12km long precious metal enriched epithermal exploration target on trend with the nearby Avino Au-Ag Mines. A total of >5000 rock samples were taken which identified significant potential for a deposit buried under gravel cover. In Q2, 2018, the company drill tested the best targets on the CLM West Property and discovered several encouraging precious and pathfinder metal anomalies which will be subject to follow-up exploration in the future.

Exploration in the Area of the Cerro

Southern Silver explored the property from late 2010 to 2012 and completed airborne and ground geophysics over the project and 15,510 metres of core drilling in 62 drill holes, with Freeport completing another 7,800m of drilling in 13 holes in 2013/14 looking for a copper porphyry system. Mineralization occurs as massive-sulphide pipes, veins and replacement deposits distributed in the skarn-altered margins of a large intrusive body in a similar geological environment to that of major Mexican Carbonate Replacement Deposits (CRDs) such as Santa Eulalia (45Mt of 310g/t Ag, 7.1% Zn and 8.2% Pb) and Skarn deposits such as San Martin (60Mt of 118g/t silver, 0.9% copper and 3.9% zinc).

By the end of 2012, two high-grade silver-polymetallic deposits, the Blind zone and El Sol zone, had been partially delineated and several other high priority targets identified throughout the property Geological modeling of the Blind and El Sol deposit using a nominal 80g/t AgEq cut-off identified multiple distinct mineralized structures with a 820 metre cumulative strike-length, and with depth projections of up to 600 metres below surface.

Between 2012 and 2014, FMEC completed a program of soil and vegetation geochemistry and geophysical surveys over the entire property. FMEC completed three additional lines of deep-penetrating IP geophysics and a gravity survey over the area of the ‘Cerro’ (or hill) that confirmed both the lateral extent of anomalies identified in earlier work by Southern Silver and significantly extended the projection of several of the existing targets to over 600 metres depth.

Summer 2013 drilling targeted the South Skarn area and specifically an offset of drill hole 12CLM-055, which previously identified strongly anomalous gold mineralization over a 20 metre interval within a hematite breccia which averaged 0.8g/t gold and included a 4.3 metre interval averaging 2.8g/t gold and 28g/t silver. A second 4.3 metre interval averaging 1.4g/t gold, 89g/t silver and 1.8% copper was intersected further down hole in an interval of chlorite-garnet skarn. A total of 4 holes were drilled in this area, which extended the strike length to 250 metres and to a depth of 300 metres below surface. This confirmed that mineralization at the South Skarn was still open along strike to the north-northeast and towards the historic La Bocona Mine and at depth.

And that one hole, (13CLM-066,), was drilled through the Blind Zone as a test for deep skarn mineralization adjacent to the central intrusion. This hole not only successfully intersected the various horizons of the Blind Zone, but also encountered wide intervals of zinc rich skarn mineralization at a depth of 600m which subsequently became part of the newly identified Skarn Front Zone that contains the majority of the resources identified to date on the property.

Additional drilling commenced in November 2013 and targeted deep porphyry style mineralization. Hole 13CLM-073 confirmed the presence of anomalous alteration and mineralization deep within the central intrusion, (see News Release dated February 27, 2014) but did not encounter economic mineralization. Two more deep holes were drilled in this area, both of which encountered wide areas of anomalous mineralization.

In May 2015, Southern Silver announced an earn-in agreement with Electrum Global Holdings L.P. that granted the right to earn an indirect 60% interest in the property by funding exploration and development expenditures of US$5.0 million on the property over a maximum 48 month period. Electrum accelerated the exploration and funding so that it has now earned the 60% interest in the property and further exploration is now proceeding forward on a 60/40 joint venture basis with Southern Silver acting as the operator. Since May 2015, drilling has expanded the Skarn Front Zone that was discovered in 2013 to a depth of >1km and a strike length of ~1.1km.

In September 2021, Southern Silver concluded a deal with Electrum to buy back their interest in the property for an aggregate of US$15 million in cash and common shares. Throughout the 2020-21 exploration, drilling has targeted delineation of the South Skarn and Bocona Zones and maiden resource estimates were released for these deposits in October 2021. Drilling continues around the margin of the Central Intrusion and in select targets on other areas of the property.

Resource Highlights

2016

On March 21st, 2016, the company released an initial 43-101 resource for the Cerro Las Minitas project of 10.8Mozs Ag, 189Mlbs Pb and 207Mlbs Zn (36.5Mozs AgEq) Indicated and 17.5Mozs Ag, 237Mlbs Pb and 626Mlbs Zn (77.3Mozs AgEq) Inferred. Click here for the full summary table and click here for the full report.

2018

On 8th January, 2018, the company released an updated 43-101 resource for the Cerro Las Minitas project of 33.6Mozs Ag, 319Mlbs Pb and 813Mlbs Zn (116.1Mozs AgEq; 1.57Blbs ZnEq) Indicated and 20.7Mozs Ag, 131Mlbs Pb and 870Mlbs Zn (92.7Mozs AgEq; 1.25Blbs ZnEq) Inferred. Click here for the full summary table and here for the full report. This works out to an approximate exploration cost of $0.07 per oz of silver equivalent in the ground, suggesting a fast and cost-effective upside potential leading to a production decision which the company plans to execute in the coming years.

2019

On 9th May, 2019, the company released an updated 43-101 resource for the Cerro Las Minitas project of 37.5Mozs Ag, 303Mlbs Pb and 897Mlbs Zn (134Mozs AgEq; 2.0Blbs ZnEq) Indicated and 45.7Mozs Ag, 253Mlbs Pb and 796Mlbs Zn (138Mozs AgEq; 2.0Blbs ZnEq) Inferred.(1). Click here for the full summary table and here for the report.

2021

On 27th October, 2021, the company released an updated 43-101 resource for the Cerro Las Minitas Project of; 42.1Moz Ag, 358Mlbs Pb and 895Mlbs Zn (137Moz AgEq; 2.3Blbs ZnEq) Indicated and 73.6Moz Ag, 500Mlbs Pb and and 1.0Blbs Zn (198Moz AgEq or 3.3Blbs ZnEq) Inferred (1). Click here for the report.

This works out to an approximate exploration cost of $0.07 per oz of silver equivalent in the ground, suggesting a fast and cost-effective upside potential leading to a production decision which the company plans to execute in the coming years.

1. The $60/t NSR cut-off value was calculated using average long-term prices of $20/oz. silver, $1,650/oz. gold. Base metals were not recovered in the leach circuit. Metallurgical work from batch test work recovered 74% silver from oxidized composites from the Blind – El Sol zones. Gold recovery was not assessed and is estimated at 70% for the purposes of this report. This work, along with marketing studies, were used to decide the NSR cut-off value. All prices are stated in $USD.

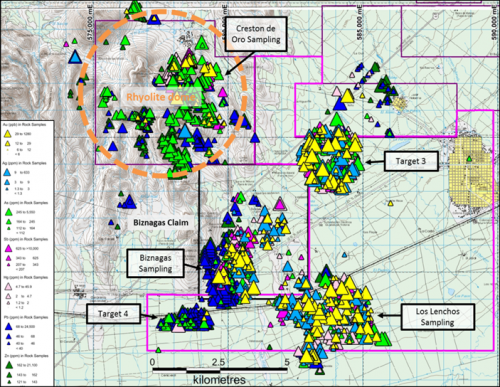

Regional Property-Wide Exploration

In 2017, a regional sampling program on the newly staked CLM West claims identified a large, 12km long precious metal enriched epithermal exploration target. A total of >2200 rock samples were taken which identified significant potential for a deposit buried under gravel cover.

Future plans are to further refine target areas within the 12km mineralized footprint and drill test the best targets with the goal of discovering a buried epithermal deposit similar to Avino or La Preciosa, which would be accretive to the existing resources on the property.